Congress Passes Emergency Paid Sick Leave & FMLA Changes Applicable to Many Employers

On March 18, 2020, the Families First Coronavirus Response Act (Act) was signed into law. The Act is designed to provide assistance to American workers in response to the novel coronavirus (COVID-19) pandemic. The Act addresses several public health related matters, but it also contains several provisions that will significantly impact U.S. employers.

The Act becomes effective in 15 days and will expire on December 31, 2020. The two major provisions of the Act that significantly impact employers are: (1) The Emergency Paid Sick Leave Act; and (2) The Emergency Family and Medical Leave Expansion Act. Notably, both Acts generally only apply to employers with fewer than 500 employees. Both are summarized below.

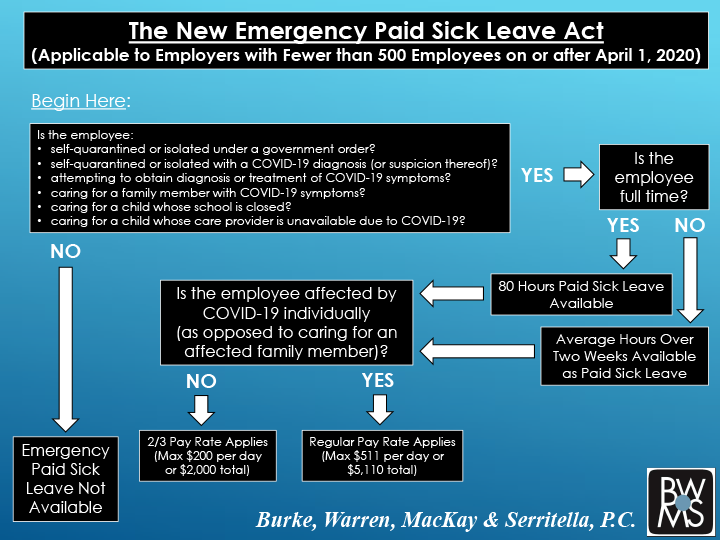

The Emergency Paid Sick Leave Act

The Emergency Paid Sick Leave Act requires employers to provide employees with two weeks of paid sick leave to self-isolate/quarantine, seek diagnosis or care for COVID-19, or to care for a child or family member with COVID-19. The Emergency Paid Sick Leave Act contains its own definitions for many of the terms used below, however, those definitions are generally the same as the terms applicable to The Emergency Family and Medical Leave Expansion Act described below. Below and [linked] is a flow chart showing how the Emergency Paid Sick Leave Act operates.

Reasons for Sick Leave: An employee may take sick time for any of the following (Note that an employer of a health care provider or emergency responder may exclude such an employee):

- Self-quarantine or isolation subject to a Federal, State, or local order;

- Self-isolation because the employee is diagnosed with COVID-19 or has been advised by a health care provider to self-quarantine;

- To obtain a medical diagnosis or care if an employee is experiencing COVID-19 symptoms;

- To care for or assist an employee’s family member who is self-isolating because the family member has been diagnosed with COVID-19, or is experiencing symptoms of COVID-19 and needs to obtain medical diagnosis or care;

- To care for the child of such employee if the child’s school or place of care has been closed, or the child care provider of such child is unavailable due to COVID-19; or

- The employee is experiencing another substantially similar condition specified by the Secretary of Health and Human Services in consultation with the Secretary of the Treasury and the Secretary of Labor.

Duration of Paid Sick Time: Full-time employees are entitled to 80 hours of paid sick time, while part-time employees are entitled to the number of hours that the employee works, on average, over a two-week period. For those employees whose schedules vary from week to week, employers must pay those employees based on the average number of hours the employee worked over the prior 6 months, or (if the employee did not work the prior 6 months – such as in the case of new employees), the number of hours the employee was expected to work.

How Paid Sick Leave Is Paid: Employers are required to pay paid sick time at the greater of: (a) the employee’s regular rate or (b) the applicable minimum wage. However, when employees are using paid sick time to care for their family members or are experiencing symptoms of a substantially similar condition, they are only entitled to two-thirds of this amount, with a maximum of $200 per day or $2,000 in total. When employees are self-quarantined as a result of exhibiting COVID-19 symptoms or under a self-quarantine order, they are not required to be paid an amount exceeding $511 per day and $5,110 in total.

Immediate Availability: Paid sick leave will be available for the employee to use immediately, regardless of how long the employee has been employed.

In Addition to Other Paid Sick Leave: If an employer already provides paid leave to its employees, it must provide the paid sick leave provided for by The Emergency Paid Sick Leave Act, in addition to its already existing paid leave.

Sequencing: An employee may first use the paid sick leave under The Emergency Paid Sick Leave Act and employers may not require employees to use other paid leave before the employee uses the paid sick time under The Emergency Paid Sick Leave Act.

No Preemption: The Act does not preempt any local and state law requirements regarding paid sick leave.

No Replacement: Employers are not allowed to condition the use of paid sick leave on the employee finding a replacement to “cover” for them.

No Carry-Over: Paid sick leave hours cannot be carried over after December 31, 2020.

No Retaliation: Any employers found to have retaliated against any employee for utilizing paid sick leave or filing a complaint alleging violations of the Act, will be considered to have violated the Fair Labor Standards Act (FLSA).

Penalties for Violation: A violation of the law is a minimum wage violation under the FLSA. The penalties include lost wages, liquidated damages, and attorney’s fees and costs. A intentional violation may result in up to a $10,000 fine and up to six months in prison for repeat offenders.

Notice: The law further requires employers to notify their employees of their rights under The Emergency Paid Sick Leave Act by posting a notice in a conspicuous location. The Secretary of Labor has been directed to make available a compliant notice within 7 days of enactment of the Act.

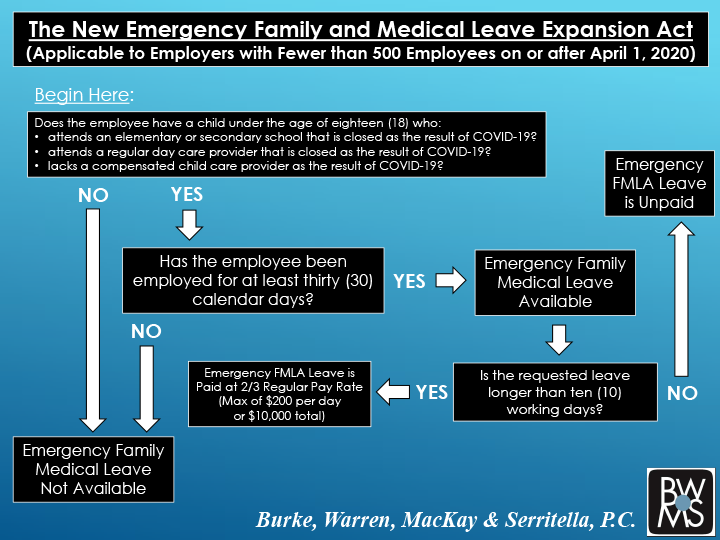

The Emergency Family and Medical Leave Expansion Act

The Emergency Family and Medical Leave Expansion Act amends the Family and Medical Leave Act (FMLA) on a temporary basis and provides eligible employees with up to 12 weeks of FMLA-protected leave for reasons related to COVID-19. Below and [linked] is a flow chart showing how the Emergency Family and Medical Leave Expansion Act operates.

Expanded Definition of “Eligible Employee”: Any employee (full or part-time) who has been employed for at least 30 calendar days by the employer. This broadens the scope of eligibility, which required that the employee work for an employer for 12 months and have worked 1,250 hours in the 12 months prior to taking leave.

Alternate Definition of “Covered Employer”: An employer with fewer than 500 employees (including all employees at separate locations and divisions if they are a single integrated company). The Secretary of Labor has the authority to exclude certain health care providers and emergency responders from the 30-day employment requirement and to exempt small businesses with fewer than 50 employees when the imposition of such requirements would “jeopardize the viability of the business as a going concern.”

FMLA Leave for School Closures: An eligible employee can take COVID-19-related FMLA leave to care for the employee’s son or daughter under 18, if the child’s school or place of care has been closed, or the child’s “child care provider” is unavailable, due to a public health emergency. Note, the term “school” used above only includes elementary and secondary schools – not colleges and universities. Moreover, a “child care provider” must be “a provider who receives compensation for providing child care services on a regular basis,” not simply an unpaid family member who watches the child. Importantly, this has an immediate impact on all Illinois employers given all K-12 schools have been ordered closed through March 30, 2020 due to COVID-19 concerns.

Paid Leave Requirement: Whether covered employers are required to provide paid FMLA leave to their eligible employees when taking COVID-19-related FMLA leave depends on the length of the leave:

- First 10 Days: The first 10 days of COVID-19-related FMLA leave are unpaid. However, an employee may elect to substitute any accrued vacation leave, personal leave, or medical or sick leave for unpaid leave. Moreover, employers cannot force employees to use any accrued paid leave for unpaid leave.

- After the Initial 10 Days: After the 10 days of unpaid leave, covered employers must provide paid COVID-19-related FMLA leave at no less than two-thirds the employee’s regular rate of pay for the number of hours the employee would have been normally scheduled, not to exceed $200 per day and $10,000 total. Note, for those employees whose schedules vary from week to week, employers must pay those employees based on the average number of hours the employee worked over the prior 6 months, or (if the employee did not work the prior 6 months – such as in the case of new employees), the number of hours the employee was expected to work.

Notice Requirement: In the case of foreseeable COVID-19-related FMLA leave, employees are only required to give enough notice as is practicable.

Restoration to Position: COVID-19-related FMLA leave is job-protected and employees taking COVID-19-related FMLA leave must be restored to their same or equivalent position when they return to work. However, employers with less than 25 employees do not have to restore employees taking COVID-19-related FMLA leave to their same or equivalent position if the employee’s position does not exist after the employee’s leave due to economic conditions or other changes in operating conditions of the employer and are caused by a public health emergency during the period of leave and the employer makes reasonable efforts to restore the employee to an equivalent position and the employer makes efforts to contact any displaced employee for up to a year after they are displaced.

While this can be incredibly expensive for employers, the Act also provides for refundable tax credits to be paid to employers to cover the costs associated with The Emergency Family and Medical Leave Expansion Act and The Emergency Paid Sick Leave Act. The Act also provides for expanded access to unemployment benefits.

Related Professionals

- Partner

- Partner

Related Practices & Industries

Sign-Up

Subscribe to receive firm announcements, news, alerts and event invitations.